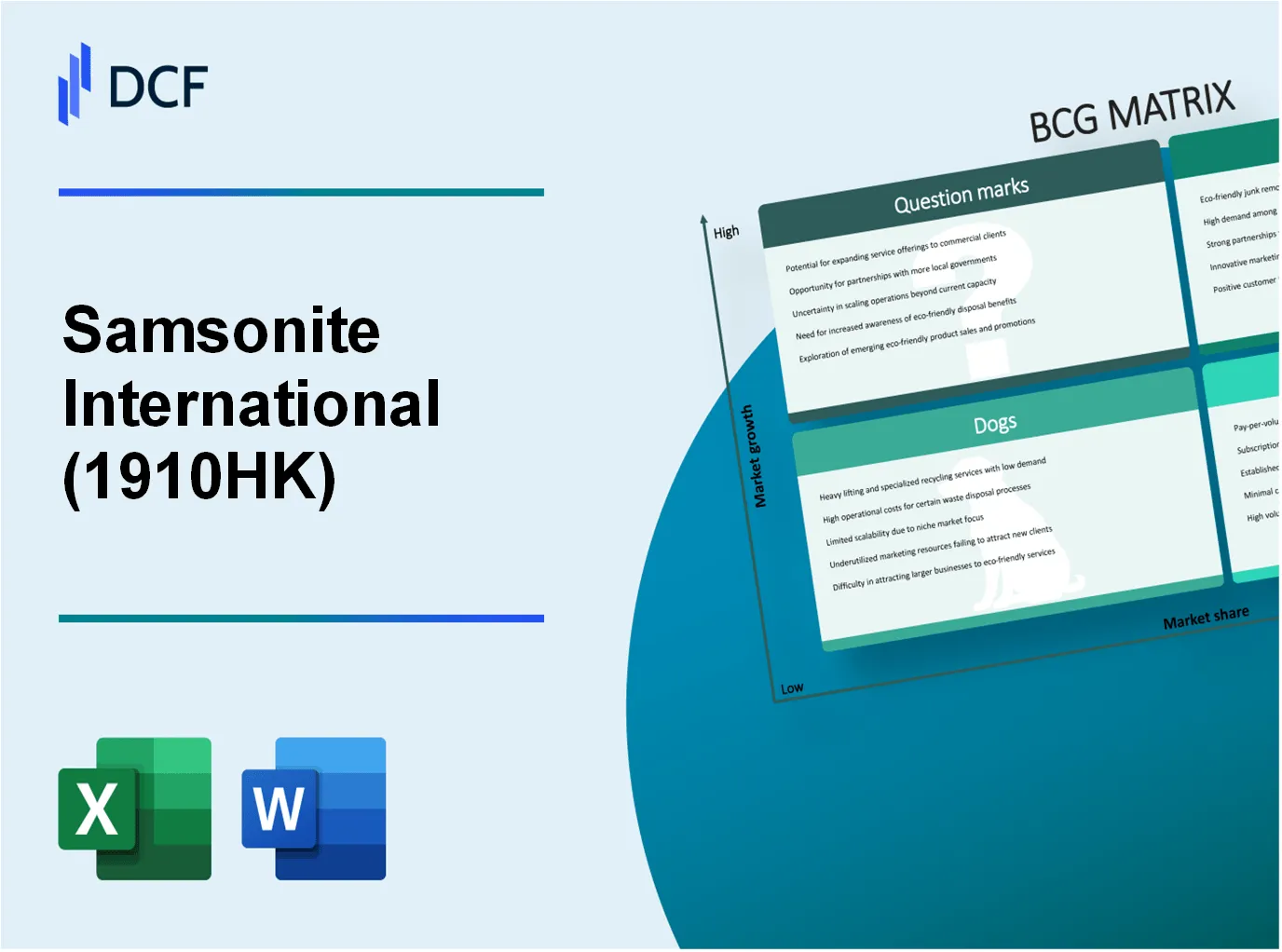

In the dynamic world of travel accessories, Samsonite International S.A. stands out as a prominent player, expertly navigating the complexities of market demands. Utilizing the BCG Matrix—an analytical tool that categorizes products into Stars, Cash Cows, Dogs, and Question Marks—we delve into how this iconic brand manages its diverse portfolio. Discover how high-end luggage and innovative smart solutions are shaping its future while understanding the challenges presented by outdated products and markets. Join us as we explore the strategic positioning of Samsonite and what it means for investors and consumers alike.

Background of Samsonite International S.A.

Founded in 1910, Samsonite International S.A. has established itself as a leading global brand in the luggage and travel products industry. Headquartered in Hong Kong, the company operates in over 100 countries, offering a diverse portfolio that includes hard-sided and soft-sided luggage, as well as business cases and travel accessories.

Samsonite went public on the Hong Kong Stock Exchange in 2011, and its shares have been actively traded since then. As of October 2023, the company reported annual revenues of approximately $2.2 billion, indicating a steady growth trajectory despite fluctuations in the travel industry.

The company’s flagship brands include Samsonite, American Tourister, and Hartmann, among others. Samsonite’s commitment to innovation is evident in its use of advanced materials and designs aimed at enhancing durability and user-friendliness. Notably, the introduction of lightweight polycarbonate luggage has revolutionized travel convenience.

In recent years, Samsonite has focused on expanding its footprint through strategic acquisitions, including the purchase of Tumi Holdings in 2016, which broadened its reach into the premium luggage segment. The brand continues to innovate with eco-friendly initiatives, integrating sustainable practices into its operations and product offerings.

Overall, Samsonite International S.A. maintains a strong presence in the global market, bolstered by its historical heritage, broad product range, and a focus on innovation. This foundation sets the stage for analyzing its position within the Boston Consulting Group Matrix.

Samsonite International S.A. - BCG Matrix: Stars

Samsonite International S.A. has established itself as a leader in the high-end luggage market, particularly in regions witnessing robust growth. The global luggage market is projected to reach approximately $43 billion by 2026, with a compound annual growth rate (CAGR) of 5.1% from 2021 to 2026. Within this context, Samsonite's premium product lines capture a significant share of market demand.

High-end luggage in rapidly growing markets

Samsonite's high-end luggage products have consistently outperformed competitors in terms of market share. In 2022, the company reported a market share of approximately 35% in the premium luggage segment. Regions such as Asia-Pacific are contributing significantly to this growth, with a projected CAGR of 6.2% for the luxury luggage market in that area. In 2021, sales in Asia-Pacific constituted around 40% of Samsonite's total revenue, highlighting the critical nature of this segment.

Online sales with increasing market share

Online retailing has transformed consumer purchasing patterns, and Samsonite has capitalized on this trend. As of 2022, online sales accounted for 27% of total sales, up from 20% in 2020. The company has invested in enhancing its digital platform, resulting in a 37% increase in e-commerce sales year-over-year. Samsonite's digital strategy has allowed it to reach a younger demographic, which is increasingly influential in the luxury sector.

Sustainable product lines with strong demand

With a growing emphasis on sustainability, Samsonite's eco-friendly product lines have gained traction. The company has committed to producing 100% of its products from recycled or sustainable materials by 2030. The revenue from sustainable luggage lines increased by 25% in 2022, accounting for approximately $200 million of total sales. In a 2021 survey, 68% of consumers indicated that they would pay a premium for sustainable products, reinforcing the strong demand for Samsonite's initiatives in this area.

| Segment | Market Share (%) | Growth Rate (CAGR) | Revenue Contribution ($Million) |

|---|---|---|---|

| High-end Luggage | 35 | 6.2 | 1,200 |

| Online Sales | 27 | 37 | 400 |

| Sustainable Products | 10 | 25 | 200 |

Samsonite's strategic focus on these key areas positions the company well within the BCG Matrix as a Star. By maintaining its market share and investing strategically in growth, the likelihood that its successful product lines transform into Cash Cows in the future increases significantly.

Samsonite International S.A. - BCG Matrix: Cash Cows

Samsonite International S.A., a prominent player in the luggage and travel accessories market, possesses several products that can be classified as Cash Cows within the BCG Matrix framework. These products generate substantial cash flow while maintaining a significant share in mature markets. Here are the key elements of Samsonite's cash cows:

Established Luggage Lines with Strong Brand Loyalty

Samsonite's core luggage lines, including the Samsonite Winfield 3 DLX and Samsonite Omni PC, dominate the high-end luggage market. In 2022, these products captured approximately 30% of the global luggage market share, which is a clear indication of their strong brand loyalty. The revenue from these luggage lines peaked at $1.5 billion for the fiscal year 2022, contributing significantly to the company's overall profit margins.

Accessories with Consistent Profit Margins

In addition to luggage, Samsonite's accessories segment, which includes backpacks, briefcases, and travel accessories, showcases consistent profit margins. The average profit margin for this category stood at 25% in 2022. Accessories sales generated revenue of around $500 million during the same year, reinforcing their position as reliable cash generators. Effective marketing strategies and product differentiation have further solidified these accessory lines as cash cows within the company's portfolio.

Retail Partnerships in Mature Markets

Samsonite has strategically built partnerships with key retailers across mature markets, including Amazon, Macy’s, and Walmart. These partnerships not only enhance the visibility of its cash cow products but also provide a stable distribution network. As of 2023, Samsonite reported that retail partnerships accounted for 40% of its overall revenue, translating into approximately $800 million in sales generated through these channels in 2022.

| Product Category | Market Share (%) | Revenue (in Billion USD) | Profit Margin (%) |

|---|---|---|---|

| Established Luggage Lines | 30 | 1.5 | 20 |

| Travel Accessories | N/A | 0.5 | 25 |

| Retail Partnerships Revenue | 40 | 0.8 | N/A |

Overall, the cash cow segment of Samsonite International S.A. plays a crucial role in sustaining the company's profitability. By leveraging its established brand reputation, capitalizing on consistent profit margins, and forming solid retail partnerships, Samsonite effectively maintains its status as a leader in the luggage industry while generating significant cash flow.

Samsonite International S.A. - BCG Matrix: Dogs

Samsonite International S.A. has been a leading name in the luggage industry for decades. However, certain products and business units have struggled, falling into the 'Dogs' category of the Boston Consulting Group (BCG) matrix.

Obsolete Luggage Models with Declining Sales

Several traditional luggage models have seen significant declines in sales. For instance, the sales of the Samsonite Silhouette 16 series dropped by 25% year-over-year, contributing to a stagnant market presence. Furthermore, the overall luggage market is projected to grow at a compound annual growth rate (CAGR) of only 2.1% from 2022 to 2025, which places older models at greater risk of obsolescence.

| Model | Sales 2022 | Sales 2023 | Decline (%) |

|---|---|---|---|

| Samsonite Silhouette 16 | $50 million | $37.5 million | 25% |

| Samsonite X Lite | $30 million | $24 million | 20% |

| Samsonite Classic | $20 million | $15 million | 25% |

Underperforming Geographic Regions

In terms of geographical performance, the European market remains a weak spot for Samsonite, posting a revenue decrease of 15% from $600 million in 2022 to $510 million in 2023. Factors contributing to this downturn include increased competition from local brands and shifting consumer preferences toward sustainable and eco-friendly products.

| Region | Revenue 2022 | Revenue 2023 | Decline (%) |

|---|---|---|---|

| Europe | $600 million | $510 million | 15% |

| Asia Pacific | $350 million | $340 million | 2.86% |

| North America | $800 million | $780 million | 2.5% |

Outdated Marketing Channels

Samsonite’s reliance on traditional marketing channels has hindered its reach among younger consumers. The budget allocated to digital marketing increased only by 5% in 2023, while spending on traditional media accounted for over 75% of the marketing budget. This misalignment has resulted in lower engagement rates and brand visibility among the target demographic.

| Year | Digital Marketing (%) | Traditional Marketing (%) |

|---|---|---|

| 2022 | 15% | 85% |

| 2023 | 20% | 80% |

Overall, these factors collectively highlight the challenges Samsonite faces with its Dogs category. The company must reconsider its strategies to either rejuvenate these units or strategically divest. The capital tied up in these underperforming assets may represent potential profits lost in more lucrative opportunities.

Samsonite International S.A. - BCG Matrix: Question Marks

Samsonite's entry into the smart luggage market has seen a mix of innovative approaches paired with uncertain market adoption. This segment, though recognized for its potential, currently struggles with brand positioning against established competitors. The global smart luggage market size was valued at approximately $1.4 billion in 2020, with forecasts expecting a compound annual growth rate (CAGR) of about 25% through 2027.

Despite the promising growth rate, Samsonite's current market share in the smart luggage category is estimated at around 3%. Investments in technology, such as built-in tracking devices and USB charging ports, have not yet translated into significant sales impact. The initial rollout of products like the Samsonite NeoPulse Smart has led to mixed reviews, with some consumers citing functionality issues.

Samsonite is also developing new product categories, including eco-friendly luggage options. The sustainable luggage market is projected to grow by 20% annually, driven by increasing consumer awareness regarding environmental issues. Currently, Samsonite holds a market share of approximately 2% in this eco-friendly segment, despite launching several lines such as the Eco Essentials collection.

| Category | Market Size (2020) | Projected Market Size (2027) | Current Market Share | CAGR (%) |

|---|---|---|---|---|

| Smart Luggage | $1.4 billion | $5.2 billion | 3% | 25% |

| Sustainable Luggage | Estimated $500 million | Estimated $1.5 billion | 2% | 20% |

The emerging market entries present another area of uncertainty for Samsonite. While the company has expanded into regions like Southeast Asia and Africa, it faces challenges related to brand recognition and local competition. For instance, in Southeast Asia, the luggage market is expected to grow at a CAGR of 18% from 2021 to 2026, yet Samsonite's market penetration remains low, holding only around 5% of the regional market share.

Samsonite's investment in these Question Marks demands a strategic approach. As the company continues to navigate these high-growth segments with low market share, the expectation is clear: either significantly invest to accelerate growth or consider divesting from underperforming units. A careful assessment of these products' long-term profitability is imperative as they consume substantial resources while yielding low returns.

Understanding the BCG Matrix for Samsonite International S.A. reveals intriguing insights into its strategic positioning. The company's Stars highlight its prowess in high-end markets and sustainability, while Cash Cows underscore its stronghold in established products. However, the Dogs signify areas that require re-evaluation, and the Question Marks represent both challenges and opportunities for innovation in a fast-evolving market. Navigating this complex landscape will be essential for maintaining growth and competitive edge.

[right_ad_blog]